Xero

From the 2020 reviews of small business accounting systems.

Xero is well suited for small businesses of any kind. A good option for freelancers and sole proprietors, Xero is completely online, offering an impressive list of features including invoicing, inventory, bank connectivity and bank reconciliation, bill payment, projects and quotes, payment acceptance, purchase orders, and multi-currency capability. Xero offers scalability, with three plans available, so users can easily scale up to a more robust plan at any time.

Xero can be accessed using a variety of devices including a desktop computer, laptop, smart phone or tablet. Xero also offers its mobile apps for both iOS and Android devices including and Xero Projects for managing projects and related costs.

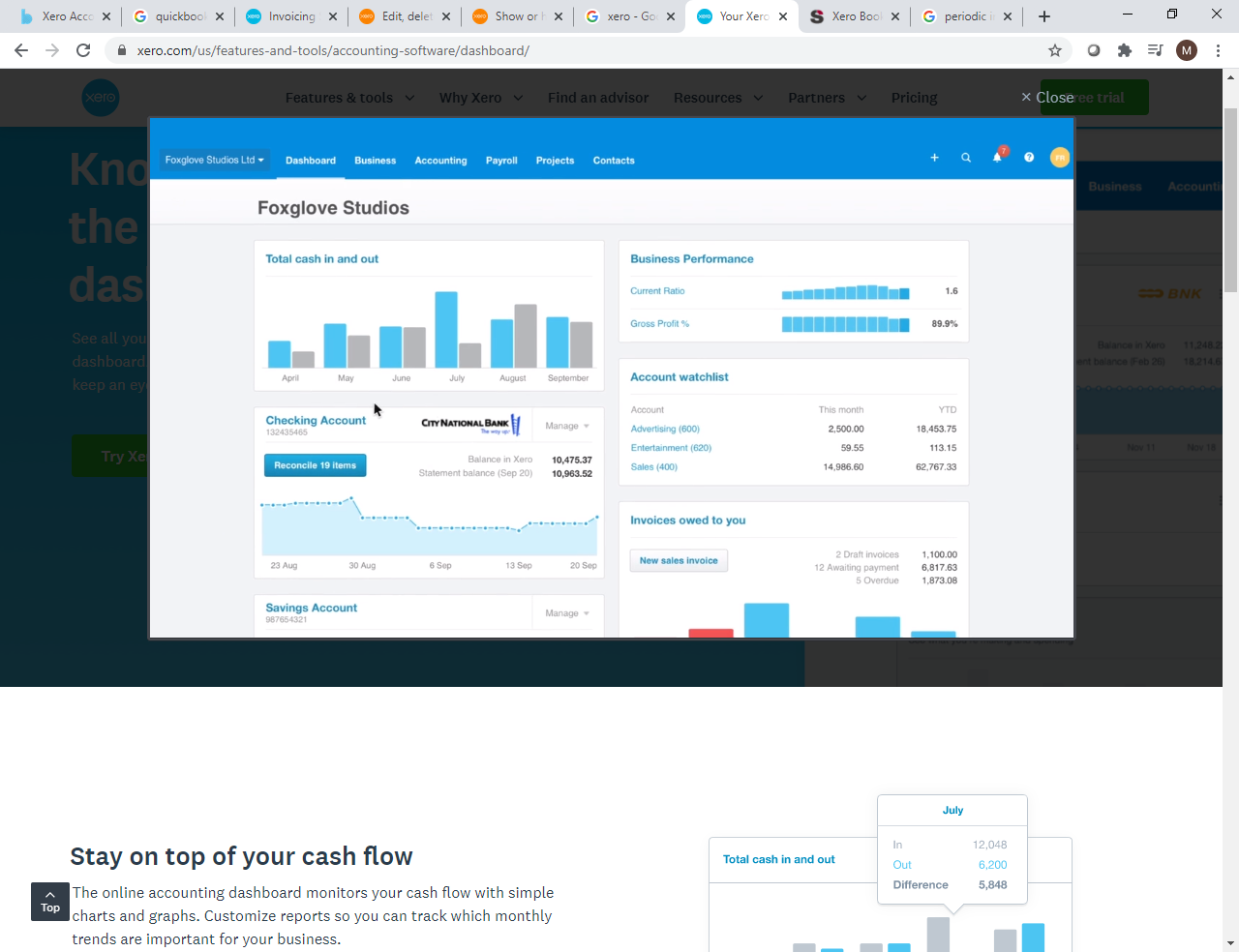

Xero offers dashboard functionality, with the application providing a summary view of total cash in and out, bank account balances, new and outstanding invoices, and sales and spending activity. Users can easily access all Xero features from the dashboard interface, and all data entry screens are easily navigatable with excellent search capability.

For QuickBooks users who are considering switching to Xero, all current data can be imported directly into the application. In addition, a budget manager function in Xero allows users to easily create and manage a series of budgets, with budget totals trackable as desired. A good inventory management feature is also available in the application which includes the ability to track stock levels, calculate cost of goods sold, and import inventory items in bulk. Integration with third-party point of sale and online e-commerce platforms offers easy front and back office financial management.

Core Accounting Capabilities: 4.5 Stars

Xero includes a standard chart of accounts which is accessible during the setup process, or users can choose to import their current chart of accounts into the application. In addition, all bank accounts and credit card accounts can be connected to the application, with income and expense transactions imported and posted to the correct account. Invoicing only takes minutes in Xero, with users able to use either the regular application or the mobile app to create an invoice. An online payment link can be included in all invoices, and any payments made by bank or credit card will be automatically posted when transactions are imported. In addition, Xero will send automatic reminders to any past due customers.

Sales tax is easily managed in Xero, which supports additional or special tax rates. Customers, products, vendors and services can all be added on the fly, and Xero offers users the option to provide customers with a discount on any invoice. Recurring invoices can also be created in Xero, with a customer’s credit card charged automatically each month. The Bills screen in Xero allows users to view the status of all bills, including those awaiting approval and those awaiting payment. Xero does not include payroll capability, but integrates with Gusto, which can process payroll in all 50 states.

Relationship Management 4.75 Stars

Xero’s Contacts feature allows easy management of both customer and supplier details, including a complete transaction history including invoices, bills, and more frequently purchased products and services. Users can manage payment history, add a discount to a customer account, and add a note to the customer account and a customer list can be easily integrated with a email account to create targeted communication to customers.

Cloud Capability 5 Stars

Xero is tops in its category for integration with third-party apps, currently integrating with more than 800 apps in a variety of categories including Accountant Tools, Bills and Expenses, Documents, e-Commerce, Inventory, Invoicing, Payments, Point of Sale, Practice Management, Reporting, and Time Tracking. The application allows users to pay vendors electronically and also accepts online payments from customers. The mobile app for both iOS and Android is free, with Xero continually adds new app integrations on a regular basis.

Management Features: 5 Stars

The Xero dashboard offers a quick summary of vital accounting metrics such as bank balances, invoice totals, total cash in and out, and a list of accounts to watch. The dashboard is completely customizable, so users can choose to display only the information they’re interested in viewing. A business performance dashboard is also available in Xero that looks at performance over a specific period of time, as well as a 12-month average by comparing budgeted totals with actual numbers over the period specified. Xero offers all financial statements including a balance sheet, income statement, and profit and loss statement, along with a variety of reporting categories including financial, accounting, tax, sales, purchases and inventory, with users able to customize reports as needed. Reports can also be exported to Microsoft Excel for more extensive customization if desired. All Xero reports can also be exported to Google Sheets or saved as a PDF for easy reporting sharing. For users that want to share data with their accountants, Xero supports an unlimited number of users, making it easy to share program access.

Tech Issues: 4.5 Stars

Xero includes excellent importing, exporting, and conversion options, making it easy to share data to and from other third-party accounting applications.

Xero offers an excellent selection of user resources, including access to Xero TV, which includes user videos, case studies, and product updates, while Xero Central offers access to a searchable knowledge base, the ability to browse training courses by topics, and access to Xero Support. Xero does not offer telephone support, but support is available via email. A setup video is available from Xero Central as are a variety of user guides which can be accessed online or downloaded if desired.

Summary & Pricing

Xero is best suited for small businesses, and is particularly well suited for those that perform numerous accounting tasks on a mobile device. Xero currently offers three plans: Early, which is $9 per month and handles 5 invoices and up to 20 bank transactions; Growing, which is $30 per month, and handles unlimited invoices and bills; and Established, which is $60 per month, and includes multi-currency capability as well as expense and project management. Those interested in Xero can try the application free for up to 30 days.

2020 Rating – 4.75 Stars

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs